On July 31st, 2024, the Bank of Japan (BoJ) stunned global financial markets by raising interest rates to 0.25%, a move that caught many by surprise. This move marked the first rate hike by the BoJ since 2007, breaking a long-standing pattern of ultra-low rates that the bank has maintained since launching its Quantitative Easing program in 2001. The BoJ pioneered this approach, introducing the program to combat Japan’s persistent deflation, and has only briefly deviated from near-zero rates in 2006 and 2007.

This decision sent shockwaves through global financial markets, starting in Japan, where the Nikkei plummeted nearly 20% over three trading days. Notably, the index suffered one of its most significant single-day drops of 12.4% on August 5th. The ripple effects were also felt across the board, with the Nasdaq 100 declining by approximately 7.5% and the broader S&P 500 falling just over 6% during the same period. The Japanese yen (JPY) foreign exchange market turbulence quickly spread to both Japanese and global equities.

What led to the market volatility?

The Yen Carry Trade – With interest rates in the US, UK, and Europe rising since March 2022 and JPY staying constant near zero, the Yen carry trade had a resurgence. This had its roots in both the institutional space and retail Japanese investors, with Hedge Funds playing the carry trade and local retail investors looking to access higher yields via dual currency deposits.

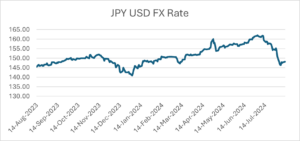

The chart below illustrates how the sale of JPY exerted pressure on the FX rate. A long USD trade yielded nearly 15% returns in the year’s first six months. However, following the BoJ’s rate hike, this trade began to unwind rapidly, significantly influencing leveraged investors. From its peak on July 3rd, the USD depreciated by 8.5%.

Source: Refinitiv Data

Rising Equity Markets – Global equities have experienced significant gains, with the first six months of this year delivering record returns, particularly in Japan and the U.S. During this period, market volatility, as measured by the VIX, remained relatively low with no significant spikes. From an investor’s perspective, this has led to crowding in specific market segments, notably the AI-driven tech stock rally. Additionally, funds aiming to maintain specific volatility levels have likely increased their leveraged exposure to meet these targets.

| Market | Jan-June 2024 |

| S&P 500 | 15.13% |

| Nikkei 224 | 18.91% |

| USD / JPY | 14.47% |

| Vix Index | -5.76% |

Source: Refinitiv Data

Volatility and Liquidity – The VIX index, a key indicator of market volatility and uncertainty, typically gravitates around its long-term average due to mean reversion. However, when market shocks occur, the VIX can spike dramatically in a short period. Over the past decade, these spikes have often been triggered by unexpected events and exacerbated by low liquidity. The VIX has remained relatively range-bound since the market stress caused by COVID-19. However, it reached a peak of 38.57 on August 5th, the highest level since November 2020, after surging 135% in just three days. This spike occurred during a period of low liquidity, typical of the summer holiday season when markets tend to be more volatile.

Source: Refinitiv Data

Unwinding and Deleveraging – The markets saw a circular effect, whereby to meet margin calls, investors reduced exposure and closed out trades. Losses in the Yen carry trade led to fire sales in Japanese equities, which led to investors selling out of US stocks. A spike in volatility also meant institutional funds very quickly started to de-lever. WSJ states this ‘was one of the largest deleveraging episodes for HF clients of GS Prime Brokerage in the past ten years’. Reversal of the momentum factor and crowding in big-tech added fuel to the fire.

These events unfolded against the backdrop of several key global macroeconomic developments, including the Bank of England’s rate decision, CPI data releases, US jobless claims, and the upcoming US rate decision in September. Equity markets have since rebounded despite the initial sharp declines, nearly returning to their previous levels. Hedge funds seized the opportunity to buy the dip in technology stocks.

Proactive Risk Management in Volatile Markets: Strategies for the Buyside

The series of events has not been isolated to a segment of the market or any particular asset class.

Market fluctuations like this require swift decision-making and quick reaction by buy-side firms to avoid being whipsawed. As demonstrated by the collapse of Archegos and the LDI crisis in the UK, sudden market fluctuations may be brief, but their impacts can be severe and long-lasting. Despite the market’s recovery, these events likely caught many investors off guard.

Here, we explore the optimal strategies for the buy side to manage such events, focusing on capital, liquidity, and margin considerations. These strategies should be part of business-as-usual playbooks and seamlessly integrated into operational workflows so that decision-makers have the information they need for proactive risk management.

Governance and Control –

- Buyside firms should perform independent margin calculations to validate the charges imposed by their prime brokers, clearing brokers, or OTC counterparties. This verification process ensures that the charges are accurate, allows for the recall of excess collateral when applicable, and provides insight into funding implications before margin calls are received. During periods of market stress, when trading volumes increase and day-over-day price changes are more significant, booking errors or misallocations can result in incorrect margin calls. The ability to independently compare calculations and hold brokers accountable is especially valuable in such scenarios.

- Funds should leverage tools like margin attribution and what-if analysis on their portfolios to identify components that consume a disproportionate amount of capital relative to the returns they generate. These tools enable funds to quickly pinpoint which trades or strategies can be closed out or transferred across brokers to reduce margin requirements and free up liquidity during periods of market stress. By doing so, funds can avoid forced liquidation events or the need to close out profitable strategies at a high cost, preserving both capital and returns.

- Identifying Trends – Regularly compare portfolio exposures and margin trends over time to understand where current margin levels stand in relation to historical peaks or relative to overall portfolio exposure. This analysis helps recognize emerging patterns and potential risk areas, enabling more informed decisions about managing margin requirements and maintaining optimal portfolio balance.

- Optimal Allocation – Using pre-trade and post-trade tools, funds should determine the best allocation for their portfolio across eligible counterparties on an ongoing basis. They are managing diversification across counterparties and not incurring excessive margin charges that drain the firm’s capital resources.

Forecasting Capital Requirements

Stress Testing – The sell side employs advanced tools to stress test client portfolios and assess overall exposures, ensuring adequate liquidity buffers and capital sufficiency during market turmoil.

Considering the current events, the buy-side must adopt these tools to anticipate potential margin fluctuations under various stress scenarios. By doing so, hedge funds can determine the appropriate levels of liquidity and unencumbered cash they need to maintain, especially in environments where leverage has increased. Hedge funds should be equipped to apply different stress tests to their portfolios, estimating margin requirements before and after stress events.

This should encompass Credit, Rates, FX, and Equity Market stresses, with the ability to model global, regional, sector, country, or security-specific shocks, including underlying price and volatility changes. Since most margin models are driven by price and volatility movements, along with potential concentration or liquidity-based charges, simulating these factors and their impact on capital requirements provides valuable insights for risk management.

Forecasting –Treasury managers can significantly benefit from forecasting the potential future exposure of their derivatives portfolios over a defined time horizon. Short-term forecasting tools, covering periods of 1 to 10 days, can serve as reliable indicators of expected variations in mark-to-market (MTM) valuations. By calibrating these forecasts to a specific confidence level, managers can accurately predict the liquidity needed and assess whether their current capital structure is sufficient to support such movements. This proactive approach helps ensure the fund is well-prepared to manage potential market fluctuations effectively.

Conclusion

In an increasingly volatile market environment, the buy side must adopt a proactive and strategic approach to managing capital, liquidity, and risk. The recent events underscore the importance of rigorous stress testing, independent margin validation, and advanced forecasting tools to navigate unexpected market shocks.

By identifying trends, optimizing portfolio exposure, and ensuring adequate liquidity buffers, funds can better withstand periods of market stress without resorting to costly liquidations or sacrificing profitable strategies. As global macroeconomic uncertainties evolve, staying agile and informed will be vital to maintaining resilience and achieving long-term success in the ever-changing financial landscape.